Double pay mortgage calculator

Second mortgage types Lump sum. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interest.

Biweekly Mortgage Calculator How Much Will You Save

Second mortgages come in two main forms home equity loans and home equity lines of credit.

. Even paying 20 or 50 extra each month can help you to pay. 15 20 30 year Should I pay discount points for a lower interest rate. Most policies cover things like personal property within the home structural damage loss of use.

To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. Should I convert to a bi-weekly payment schedule. Scotiabanks Match-a-Payment allows you to double your regular mortgage payment for any payment.

Some mortgages in Canada. The following table shows loan balances on a 200000 home loan after 5 10 15 20 25 30 35 40 45 50 years for loans on the same home. What are the tax savings generated by my mortgage.

It helps to add up all of your. Refinancing for 05 percent. Our condo mortgage calculator takes into account the loan principal number of payments per year interest rate and other costs associated with the mortgage.

15 20 30 year Should I pay discount points for a lower interest rate. So for example if you had a 200000 mortgage you have the ability to put a 20000 lump sum directly to your principal every single year. As you can see its possible to save 84655 in interest and pay off your mortgage in half the time by refinancing from a 30-year to a 15-year term.

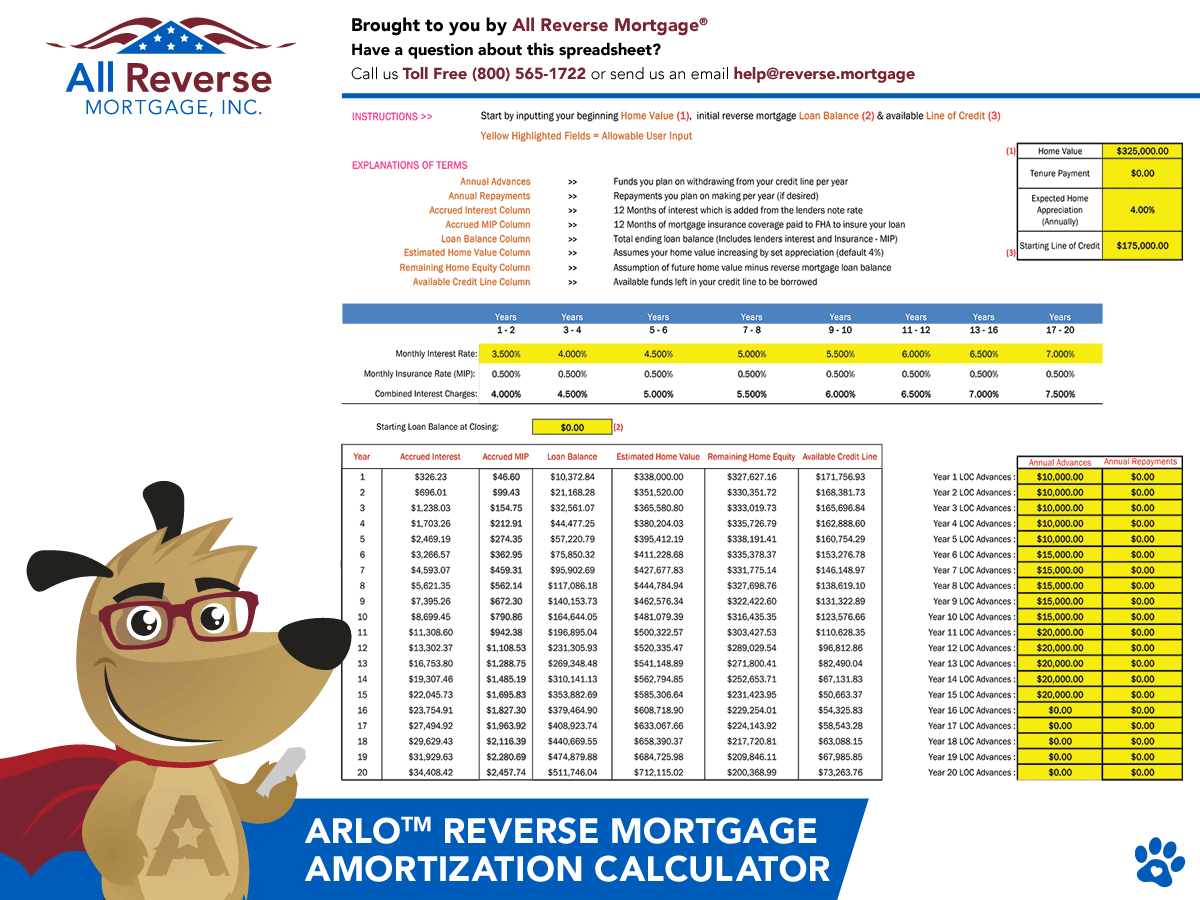

That means as time passes the monthly payments will shift more towards the principal than the interest. Income-contingent loans known as Plan 1 loans by the Student Loans Company SLC. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates.

The vast majority of people who take out mortgages have to pay anywhere from 100 to 200 extra per month on average in order to pay for mortgage insurance. Rules of thumb for quickly estimating down-payment amounts. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Should I refinance my mortgage. Saving up for a specific project and using those funds is the ideal way to pay for a home upgrade.

The interest rate is the LOWER of the following. How you pay for your home renovation depends on your financial situation and the size of the project. For example if you had a loan balance of 400000 and an offset account with 50000 in it you would only need to pay interest on 350000.

Who has them. Then enter the loan term which defaults to 30 years. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type.

The annual amount you expect to pay in property taxes. Its important you always get a specific quote from the lender and double-check the price yourself before acting on the information. Should I refinance my mortgage.

L 2530 x W 9401620 x H 1030 mm. Eventually the mortgage is paid off in full when the balance reaches 0. Comparing mortgage terms ie.

Should I rent or buy a home. Extra Mortgage Payments Calculator. English Welsh and Northern Irish students who started higher education between 1998 and 2011 and Northern Irish students starting after 2012.

How to pay off my mortgage faster with extra payments. Take the 10 number divide it by 2 The above rules of thumb will skew slightly low because they do not include closing. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Take the 10 number double it 5 down. This example shows how effectively you can reduce the time it takes to pay off your mortgage simply by doubling up one monthly payment each month. The Double-Up payment is used to pay your mortgage principal balance.

However should you pay off your reverse mortgage in full 5 years down the road you should have an interest deduction event for that payoff year. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. What are the tax savings generated by my mortgage.

This can help you pay down your mortgage faster without needing to constantly make extra contributions. Seats with Double Spring System Pocket Spring Zigzag Spring Recliner Button with USB Charging Port. Therefore youre putting that 10 right to your principal payment and reducing those overall mortgage costs.

You can either use one part to work out a single mortgage costs or both. Should I convert to a bi-weekly payment schedule. Censusgov all others NAR Quickly Estimating Down-payments.

275 How the interest rate is set. Compare a no-cost vs. The cons of a loan that lasts decades longer has over double the total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount.

Compare true mortgage costs. Perhaps you double clicked on the wrong cell. Something to consider before refinancing.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Comparing mortgage terms ie. Now lets look at how the numbers compare if you can drop your mortgage interest rate by 05 using a no-closing-cost refinance.

Should I rent or buy a home. In the mortgage calculator above you can enter any amortization period ranging from 1 year to as long as 30 years. Mortgage Overpayment Calculator shows how much you can save by paying off your mortgage early - if your mortgage allows overpayments.

Work out mortgage costs and check what the real best deal taking into account rates and fees. Visiting our website you can see all the different options to help pay your mortgage off even. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Plus the money can be accessed if you need it and more money can be deposited into the account. We cannot accept responsibility for any errors please report faults above. We also offer three other options you can consider for other additional payment scenarios.

Join the ranks of debt-free homeowners by getting intense about paying off your home loan. Compare a no-cost vs. To learn more about amortization schedules and how to create one visit the amortization schedule calculator.

Talk to your trusted tax professional. A mortgage in itself is not a debt it is the lenders security for a debt. Your Double-Up payment is applied directly against the principal balance of your mortgage which cuts down the life of your mortgage and saves interest costs.

Leather - The grain color will not be uniform creases may also form naturally - Scars blemishes are natural. Pay off your mortgage early with these helpful tips. Mortgage insurance is required for most people who have less than 20 equity in their homes in order to protect their lenders in the case of default.

The loan is secured on the borrowers property through a process. Remove the far right number from the homes price 20 down.

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

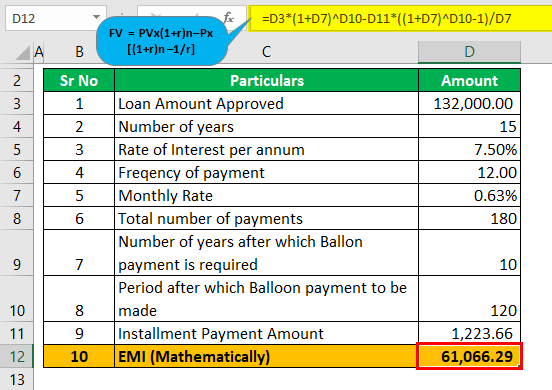

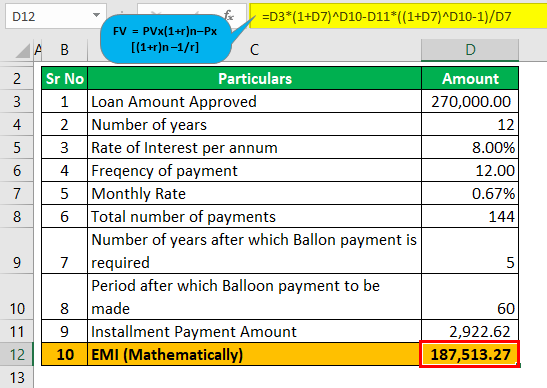

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Extra Payment Mortgage Calculator For Excel

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage With Extra Payments Calculator

How To Calculate Mortgage Payments In Excel

Free Reverse Mortgage Amortization Calculator Excel File

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Online Mortgage Calculator Wolfram Alpha

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Extra Payment Mortgage Calculator Making Additional Home Loan Payments

Extra Payment Calculator Is It The Right Thing To Do

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com